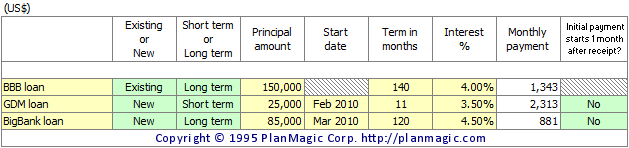

Existing and new short term and long term loans

You can add different short term and long term loans. The principal payments and the interest payments will be entered into the Cash Flow and Income Statement worksheets.

If the initial payment starts one month after receipt of the funds, you should select YES from the dropdown provided for each loan. The principal payments and the interest payments will be entered into the Cash Flow and Income Statement worksheets starting one month after receipt of the funds. If you select NO, the payments will start in the same month you receive the funds.

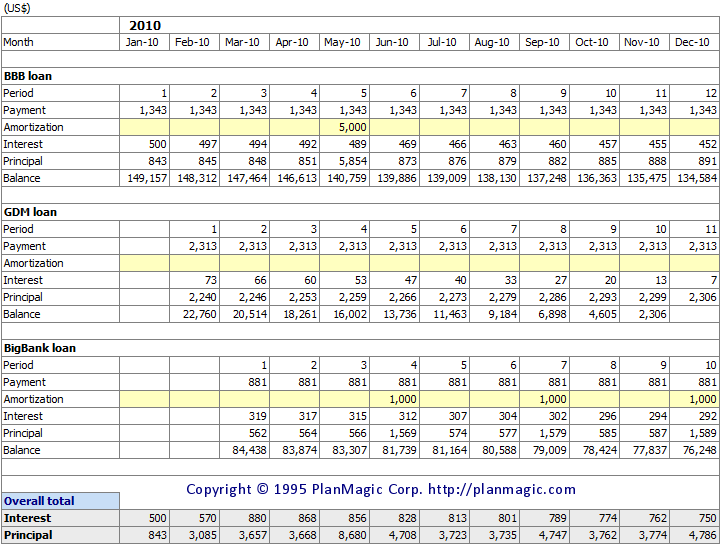

Amortization

![]()

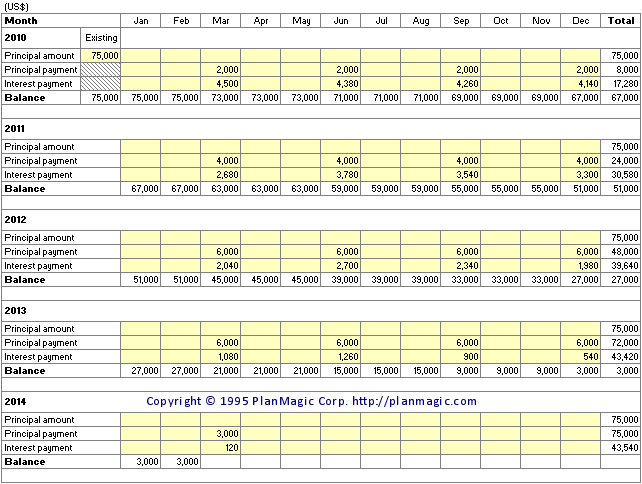

If you wish to amortize a loan in addition to the automatic amortization, click on the AMORTIZE LOANS button to go to the amortization tables. The tables are used to calculate the loan schedules and the data is then inserted into other worksheets where appropriate. Enter any payment into the Amortization rows in the month where the payment is actually done.

Loans > 5 years

Even though the Loans worksheet has a 5-year maximum term (details are only calculated and entered into the planning for up to 5 years), enter any long term loan (f.e. a mortgage of 20 years) with the correct number of months (f.e. 240 months for a 20 year mortgage). Only the first 5 years of the loan schedule are calculated and used in your planning.

Deferred loans

Enter the details of any deferred loan in this table whereby the interest rate can be 0% or more depending on the loan agreement. F.e. a shareholder may provide the loan without expecting interest and amortization payments until the business is able to do so.

Screenshot not shown here!

Manage deferred loans

![]()

If you amortize a deferred loan, click on the MANAGE DEFERRED LOANS button to go to the amortization tables.

Payments: enter any payments (principal or interest) in the Deferred Loan Schedule when actually paid.

Screenshot not shown here!

Flexible loans

Flexible loans can be handy where you wish to enter the loan amount, the amortization and interest payments as is needed. The interest payments will be booked in the Income Statement the same month they are paid.