Beginning balance sheet

In the financial workbook we have provided a beginning balance sheet (for a start-up or an existing business). The Short term and Long term loans are automatically entered from the Loan Assumptions in the Funding worksheet (see the Comments in the financial workbook for more details).

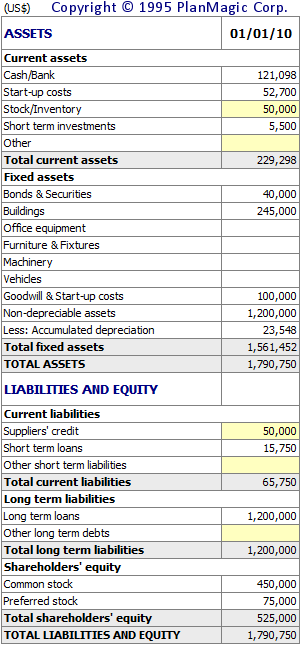

Beginning balance sheet (for a start-up)

If you have already purchased any inventory on credit on the date of the beginning balance, enter the amount of the credit under Suppliers' Credit in the Current Liabilities. If you have already purchased fixed assets, see the Existing Assets in the Investment Budget worksheet. Any fixed assets (to be) purchased must be entered in the Investment Budget, unless they are to be considered an expense. If the investment (such as a lamp, PC speakerset, etc.) can be accounted for as an expense, enter it in the Income Statement instead (see the notes and the Business Guide > Capital Expenditures).

The Cash/Bank cell

This cell is automated !

Any difference between Assets and Liabilities will result in a positive (which is fine) or negative cash/bank balance. A negative amount means you have more assets than your financing allows. Consider adding more equity or other means of financing the assets.

Start-up costs

Any start-up expenses entered in the Investment Budget to be considered expendable are inserted as a Current Asset in the Beginning Balance Sheet. This is necessary to ensure you properly finance all assets. In addition you will pay these expenses in the first month of accounting in the Income Statement under Total Operating Expenses. See the Investment Budget for more details.

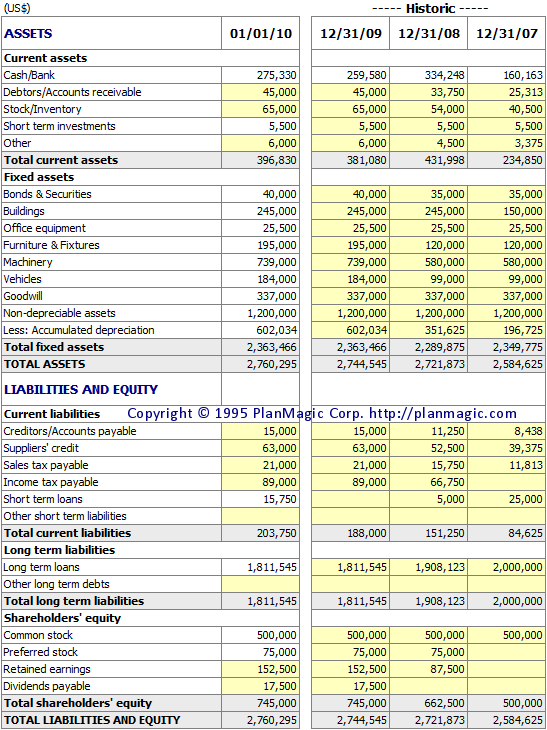

Beginning and historic balance sheet (for an existing business)

The beginning balance sheet (the first column) should include the data of your most recent balance sheet. Any additional amounts you want to include at the start of the financial plan should be inserted in the Investment Budget (Existing Assets) or Funding (Existing Loans) worksheets. Yellow colored cells can be entered as desired. The values entered in the three historic columns are only used in the Historic Ratios and are not used in other parts of the workbook since the beginning balance sheet already covers the historic data. Existing fixed assets have to be entered in the Investment Budget as Existing Assets or Developments.