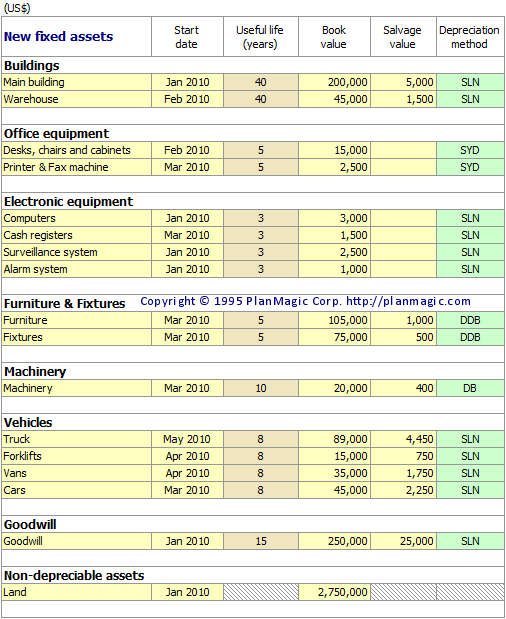

Investment budget

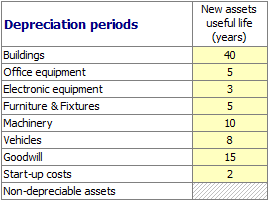

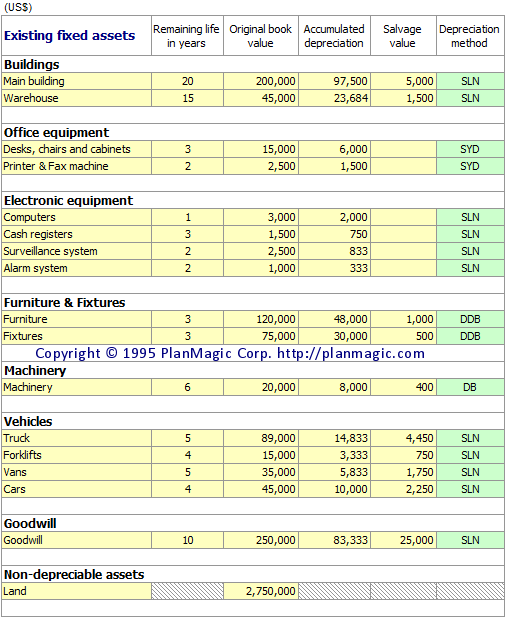

Enter the years that each category will be depreciated in. We have entered the most common defaults.

Depreciation method

You can select which depreciation method is used in the dropdown menu (SLN,DB, DDB, or SYD):

- SLN = Straight-line depreciation

- DB = Fixed-declining balance

- DDB = Double-declining balance

- SYD = Sum-of-years' digits

Start-up costs

The PlanMagic business plan products are unique and actually do this correctly.

Screenshot not shown here!

Screenshot not shown here!

Investments

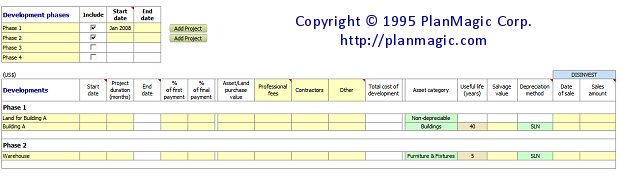

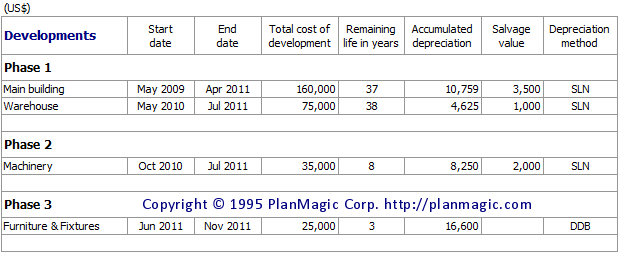

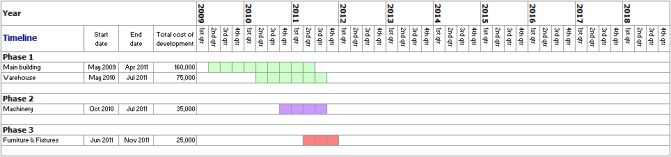

Developments

Use the developments worksheet provided to enter detailed developments projects up to 5 years prior to the beginning of the planning date as entered in the Assumptions worksheet. A summary of the developments is shown in the Investment Budget worksheet. Dates are entered as 1-2009, and so forth.

Add Project (as above) or Add Row.You don't have to manually insert rows anywhere!

There is also an automated 10-year Development Timeline available in a separate worksheet.

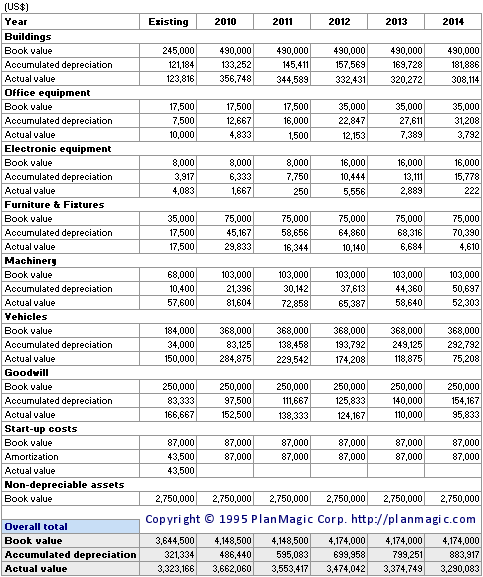

Existing fixed assets

For an existing business, enter the details of any existing assets in the table provided.

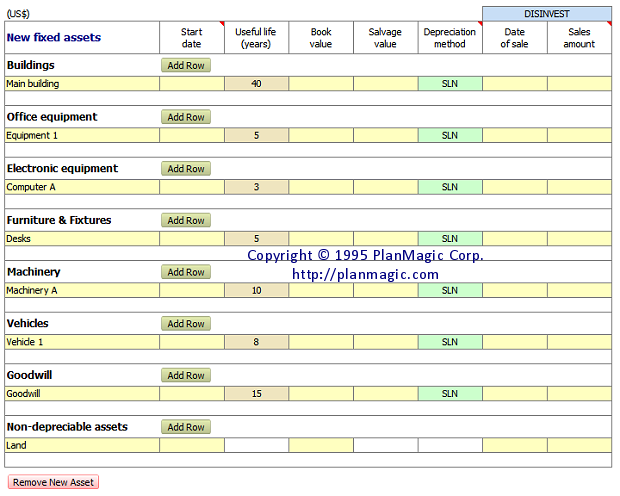

Planned investments

These tables are used for entering any planned investments that may occur in the 5 years of planning. Enter any investment in the month and year where you expect it to be paid (the cash leaves your cash flow). If a loan is acquired for the investment, also enter the loan in the Funding worksheet.

Planned disinvestments

Enter any sales of assets (disinvestment) n the month where you expect it to be sold (the cash enters your cash flow) as a negative number.

Depreciable assets 5 year summary

The fixed assets in the balance sheet include the original book values of the assets. The 5-year summary provides depreciation details for each fixed asset category.